Delivering home loan calculators that focus on customer ambition.

Collaborating with Kiwibank, we helped deliver an innovative set of home loan calculators to attract and retain a new progressive type of customer.

Better supporting customer needs.

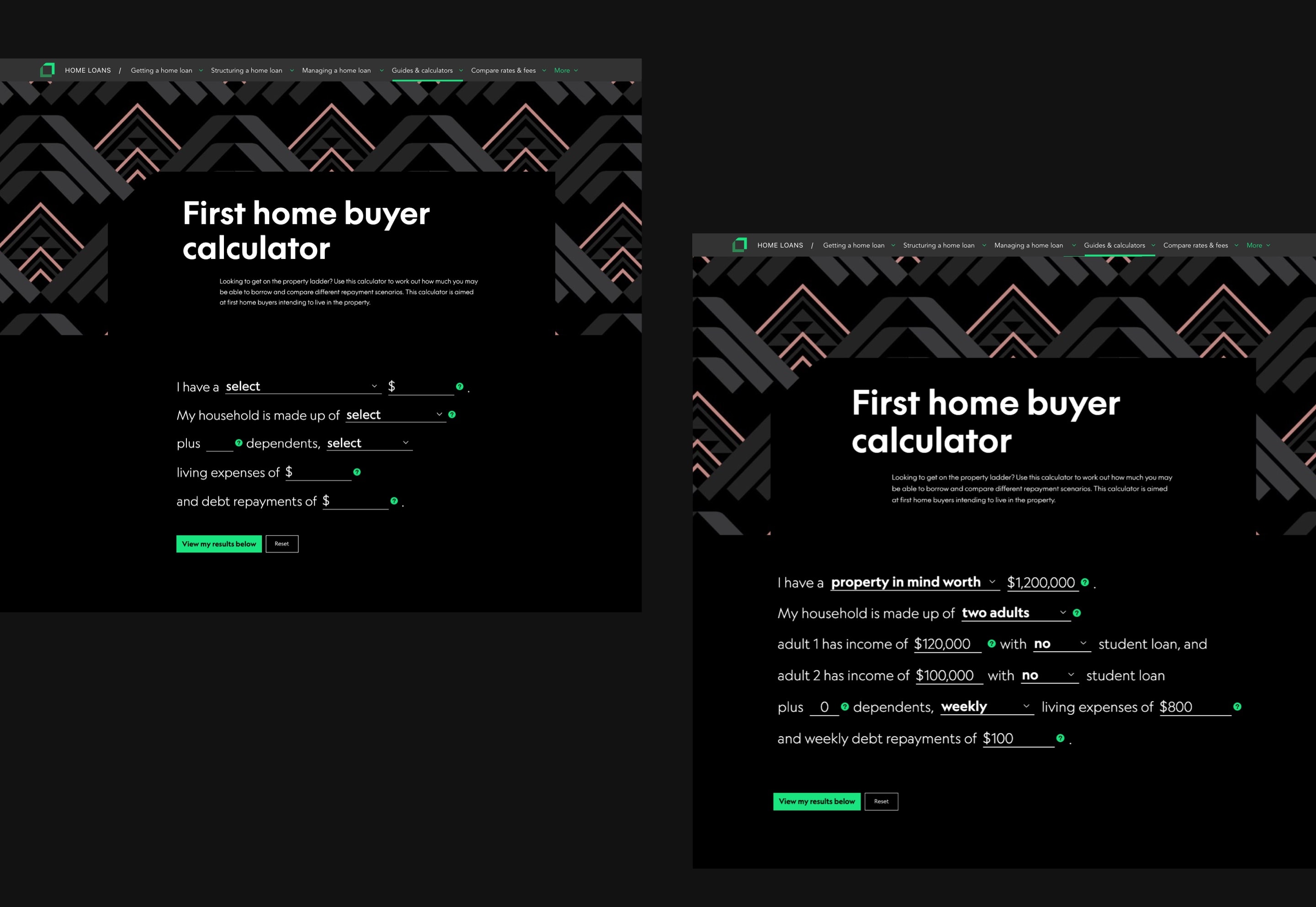

As part of a digital repositioning effort, we helped Kiwibank launch a series of interactive digital home loan tools designed to better support a number of distinct audience segments based on their specific context and needs.

Shifting focus from affordability to ambition

Home loan calculators are a high use toolset that a range of audiences use to understand their financial parameters and options.

The current typical experience of these calculators is centered on what a user can afford rather than what they want to achieve.

We wanted to challenge this convention and design calculators that better assist audiences to make confident decisions, empower customers to self-navigate and determine how Kiwibank could help them to realise their ambitions and achieve their goals in line with the brand strategy.

Generating audience insight

In-depth interviews were undertaken with potential home buyers, owners (bank agnostic) and mortgage brokers, to understand the motivations, needs and preferred interaction models of people using home loan calculators throughout their decision-making process.

Segmenting audiences by mindset

Our research concluded that differences based on age, location or financial position were not as consistently significant as the motivations for using the digital tool – which emerged as a key dimension that set user needs apart.

We identified five segments with specific motivations and mindsets - all of whom had distinctive requirements and needs.

Current calculators focus on a financial position

Our research concluded that differences based on age, location or financial position were not as consistently significant as the motivations for using the digital tool – which emerged as a key dimension that set user needs apart.

We identified five segments with specific motivations and mindsets - all of whom had distinctive requirements and needs.

Defining an overarching purpose

The key function of home loan calculators is to screen, educate and trigger a contact. These are true from the perspective of both a potential buyer and the bank’s – and were used as a decision framework throughout the design process.

Human centered with a conversion focus

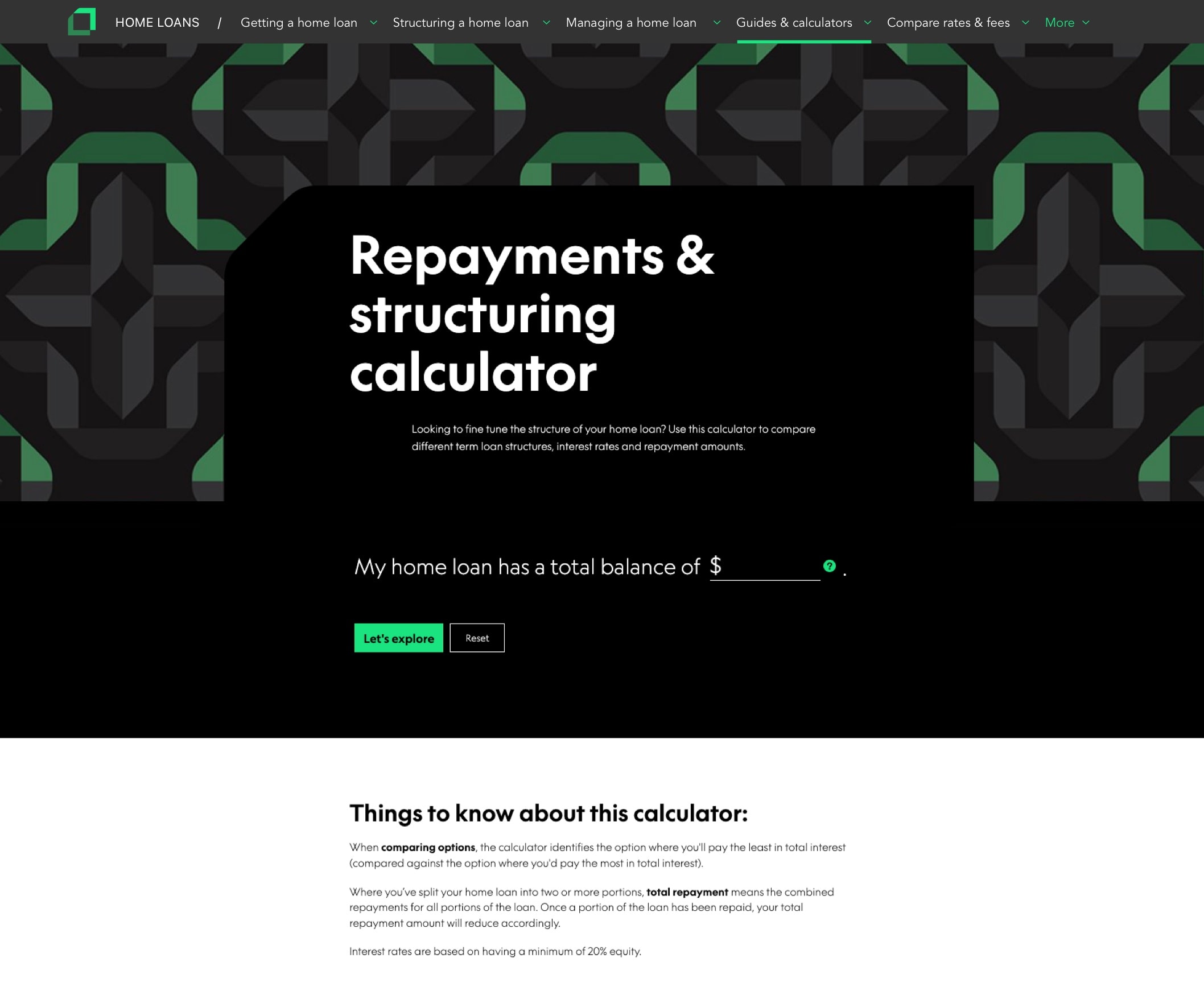

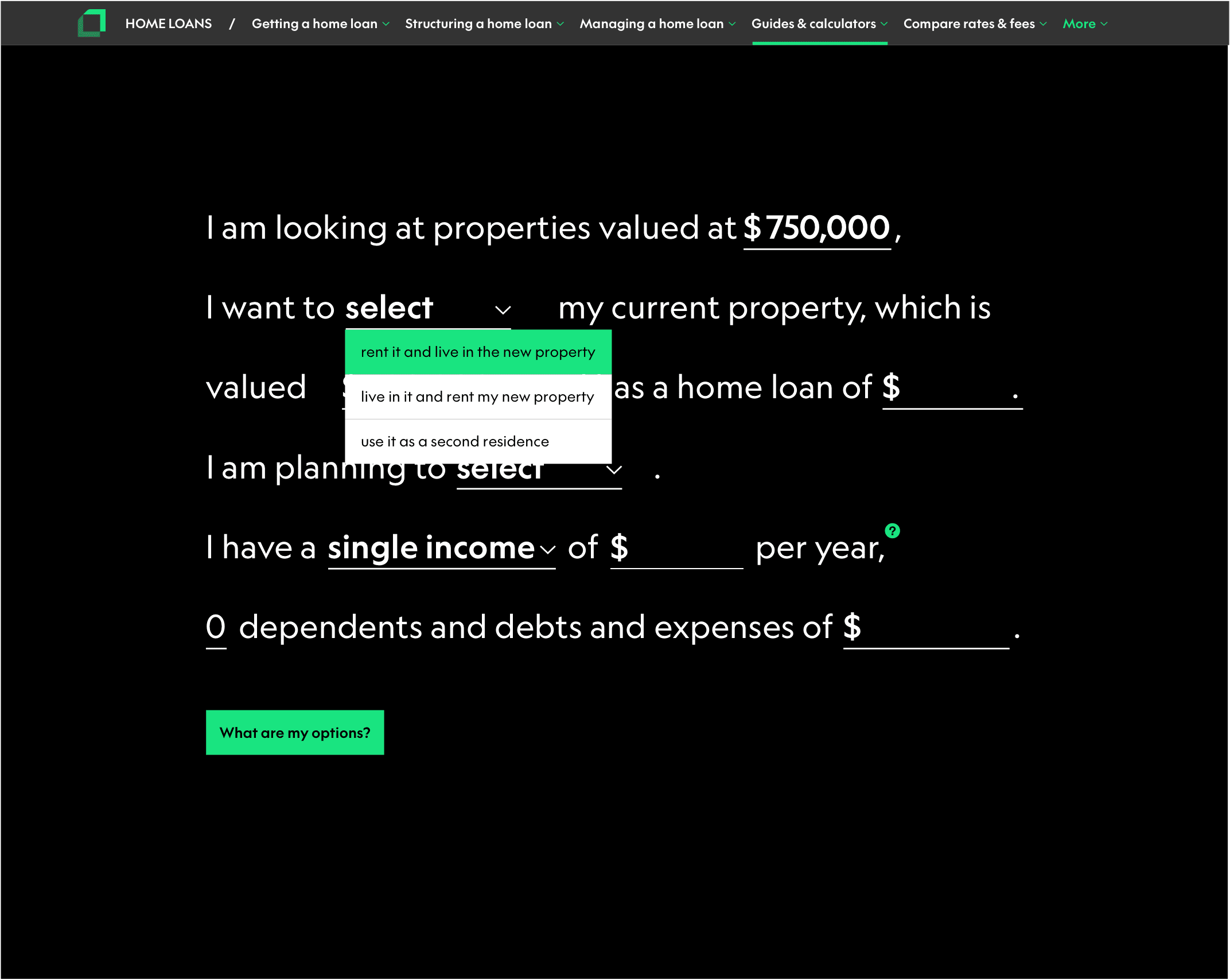

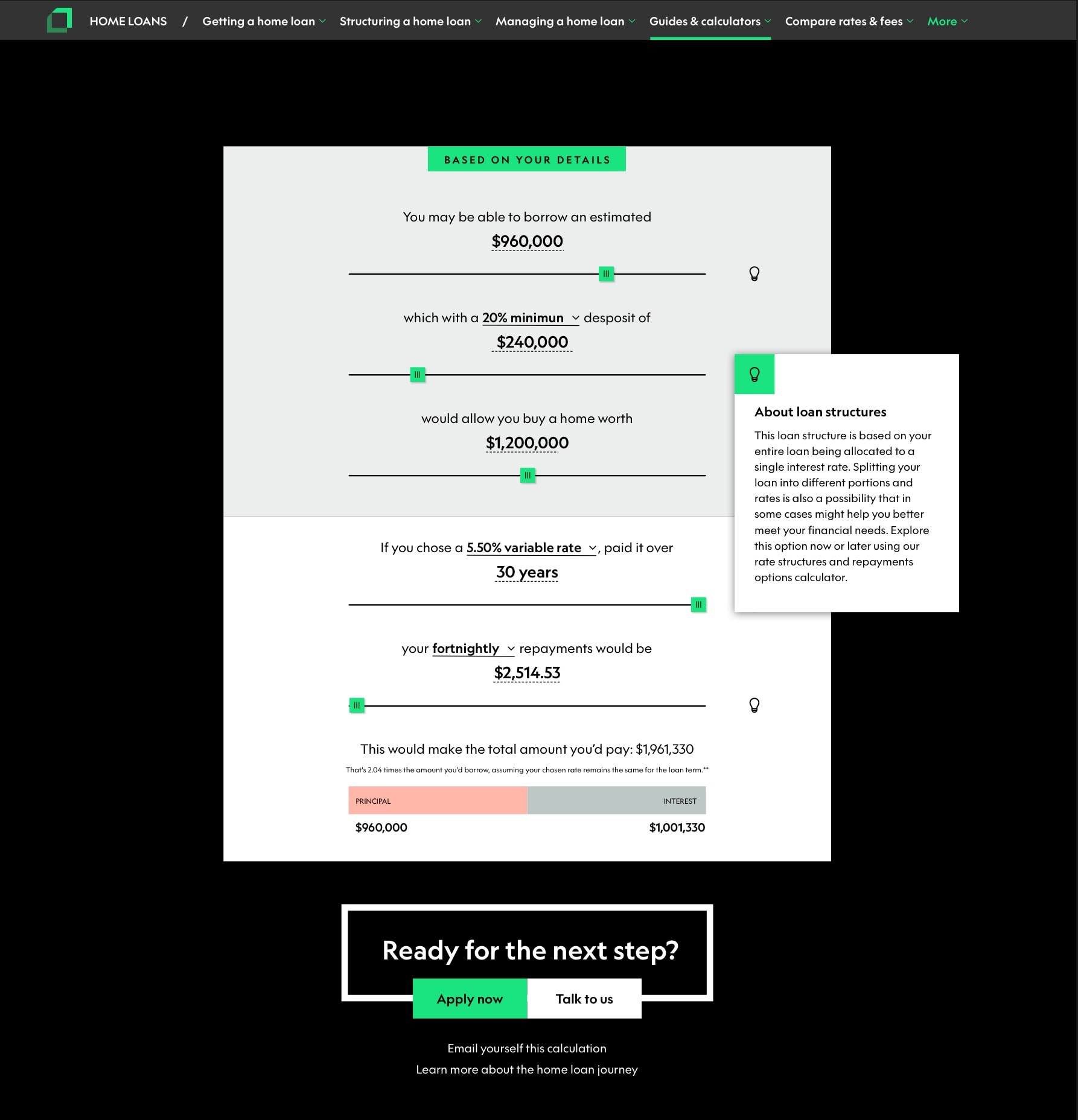

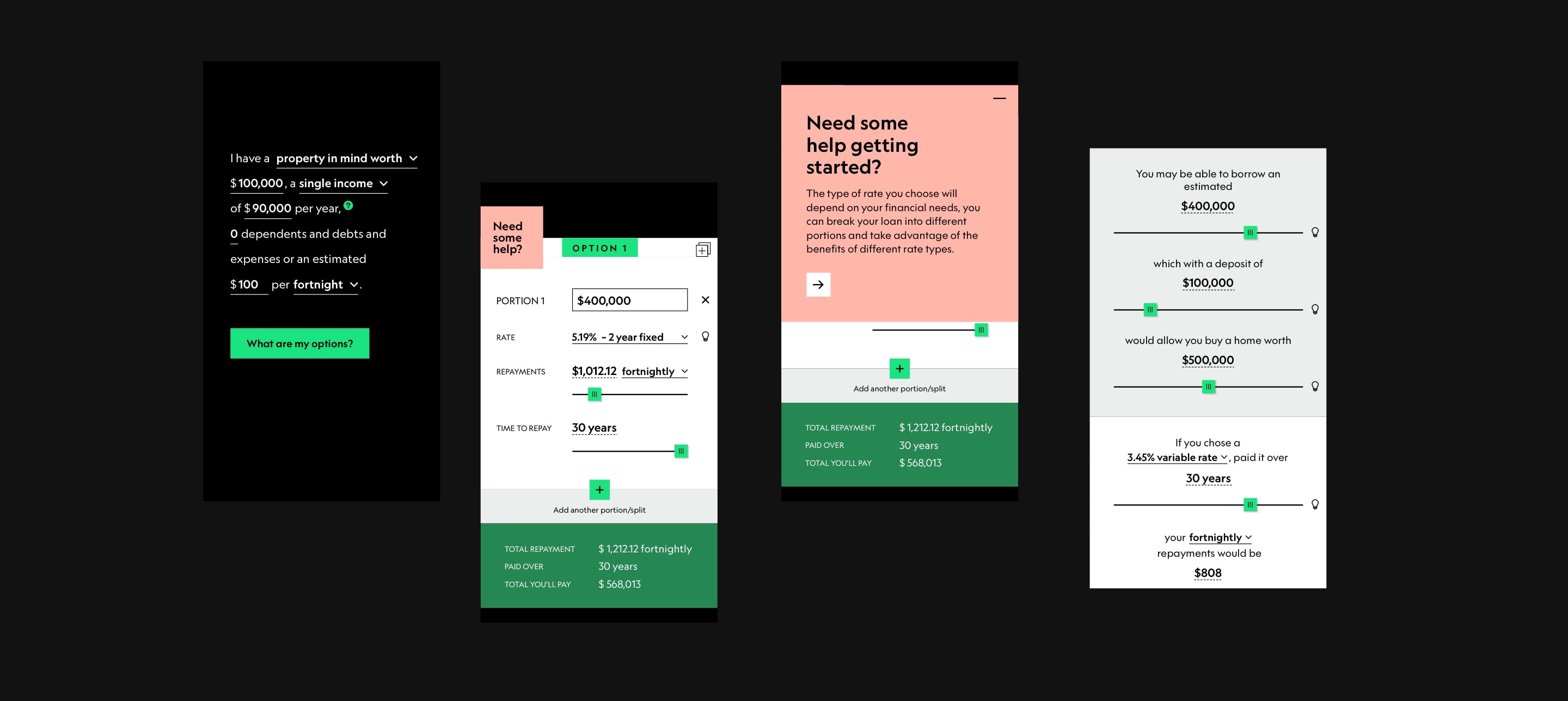

Each of Kiwibanks new home loan calculators feature a natural language interface to understand the less-variable aspects of a user's position - such as household income, debt levels and composition.

The second part of the interaction uses sliders as a mechanism to explore variables and scenarios that could shift, allowing users to understand their options and potential impacts.

Educational prompts are surfaced throughout the experience so that the user understands any high level implications throughout scenarios without having to leave the calculator interface.

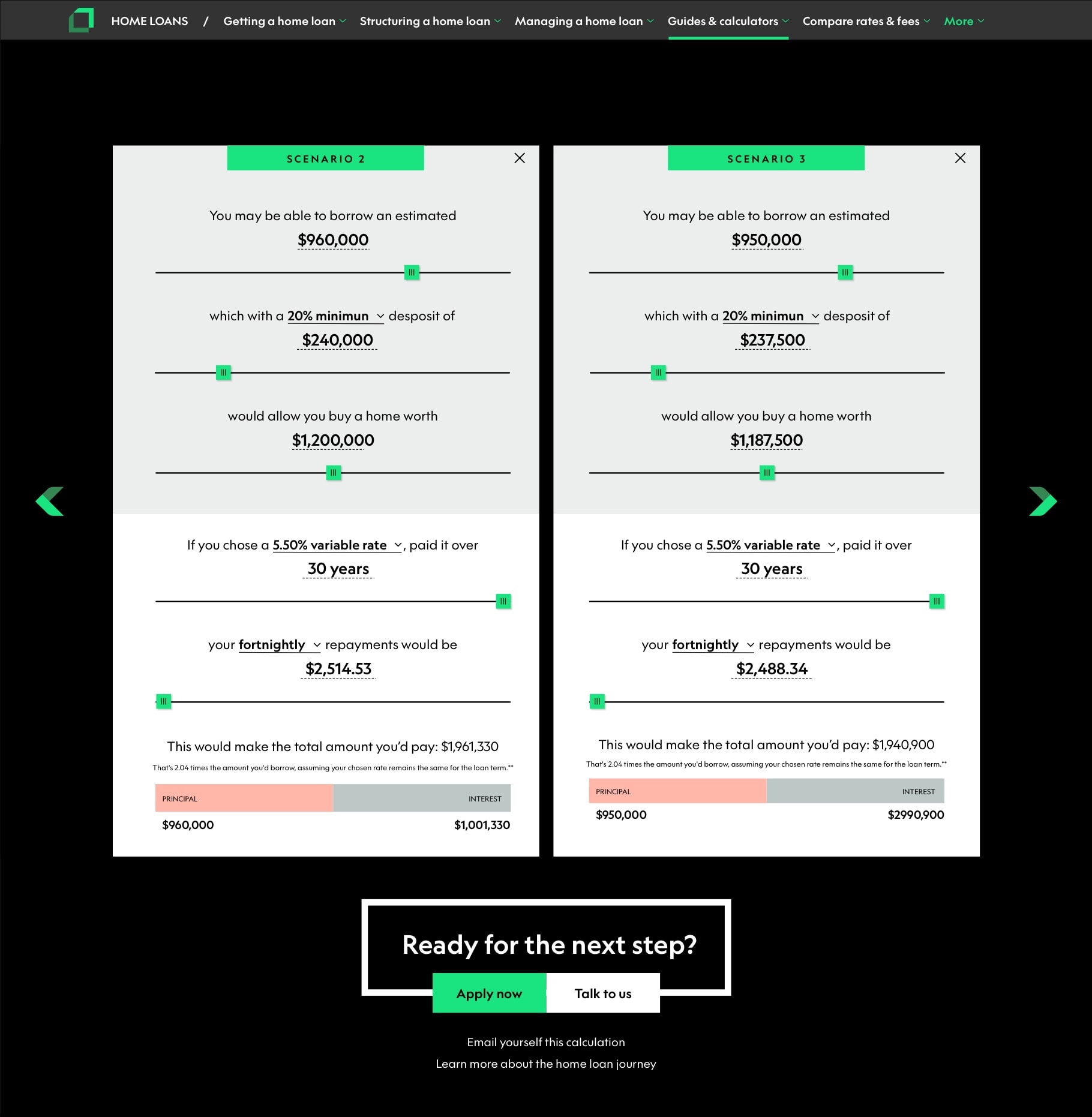

Duplicating detail in more than one scenario allows users to transition through different constructs and compare different options for how they might achieve their goals and determine the best pathway to get there.

Client: Kiwibank

Project: Home Loan Calculators

Capability: Digital strategy, Design Research, Interaction Design, UX Design, UI Design, Design Systems